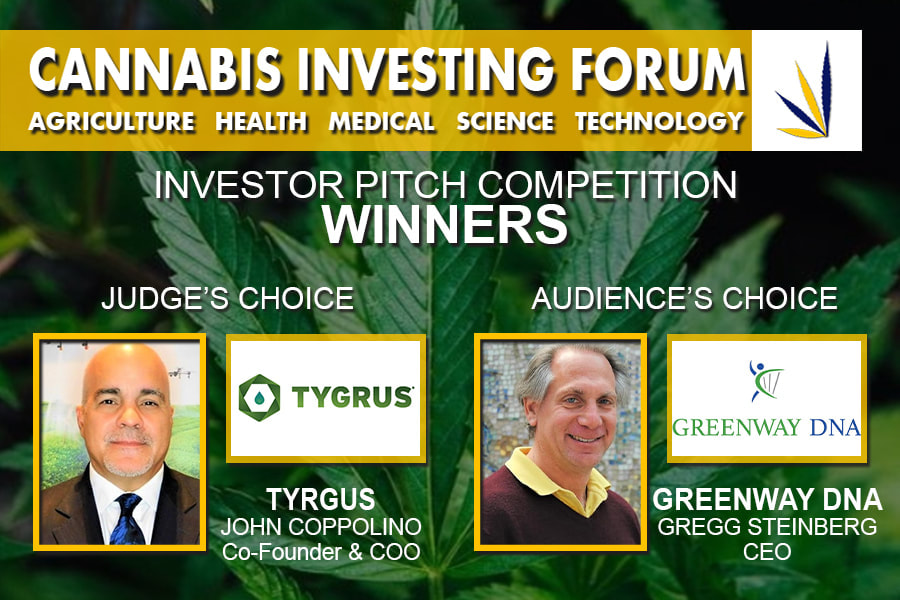

Investor Judges - Investor Pitch Competition

Cannabis Investing Forum - December 10, 2020

Cannabis Investing Forum - December 10, 2020

|

Moderator - Investor Pitch Competition

|

|

Moderator - Investor Pitch Competition

Joseph Chicas, CEO, Cannabiz Venture Partners

|

Joseph Chicas is a proven cannabis strategist that guides emerging cannabis companies through licensing, real estate acquisition and growth strategies.He's currently the Founder and CEO of Cannabiz Venture Partners and heads up strategic relations for the Leaves of Legend cannabis brand. He is a part owner in multiple cannabis licenses in California, from delivery to cultivation to retail. Joseph is also a business strategist for Nugl Media where he publishes articles and content to support cannabis entrepreneurs. He once served as the Executive Director of Cannabis Advising Partners, at a point when it was the top cannabis advising firm in California.Joseph is a former policy professor from the University of Southern California where he taught government relations and policy analysis, which are essential tools to excel in the cannabis regulatory landscape. Earlier in his career, Joseph served as an advisor to LA Mayor Eric Garcetti on economic development issues, specifically veteran affairs and small business. He obtained his BA from UCLA and his Master's Degree from USC.

About Cannabiz Venture Partners Our mission at CVP, is to help you win big in the cannabis industry. Navigating and finding success within this emerging industry is filled with risks, but are here to minimize your risks, while maximizing success. We're here to support and partner with you as you set your foundation and scale your ventures. We offer three core services to position you for success.

|

Investor Judges - Cannabis Investing Forum

Blake Becher, Founder, MySleepUSA

|

Blake’s first start up was at 18 years old and we successfully raised 5 million dollars for a VoIP company that went public in 1998. As early as 1999 he worked in cannabis cultivation, plant genetics, and sharing the love of both cannabis and hemp plants. Mr. Becher is the founder of MySleepUSA and has helped dozens of company startups in Colombia and Latin America. His contributions are instrumental to the success of these companies as they expand into the Latin American and global markets. He has several years of direct experience in business operations in Latin America. He is the co-founder of My Sleep USA, The Emerald Company, Itoco Mining, Hexa Mining, Blake Becher SAS, Hemp & Co, Blake Salmon Shop, Vocal Communications Inc. which have successfully served the international hemp markets, precious minerals, and jewelry market since 1997. He has considerable or better, vast knowledge of South American business practices, speaks 3 languages and has cultivated an international network of business relationships. He also adds a wealth of knowledge with regards to the biology and cultivation of the cannabis and hemp plant, respectively. He holds a degree in the Botany and Plant Biology of Cannabis from the Tech de Sabana.

About MySleepUSA The company is focused on naturally formulating highly effective no habit forming sleep products.

|

Carol Ortega, Managing Director, Muisca Capital Group

|

Originally from Bogotá, Colombia, Ms. Ortega is the Managing Director and Founder of Muisca Capital Group. For over 20 years, Carol has continuously demonstrated the ability to successfully guide cross-functional teams and achieve strategic goals for a diverse group of organizations at the international arena.

In Colombia, as a professor for Xavierian University, Carol leaded various research and consultancy projects within the financial industry, taught classes and was the Director of postgraduate programs in accounting. Within the governmental sector, at the Ministry of Commerce, Industry and Tourism of Colombia she provided technical lead on all matters related to the process of convergence towards international standards of accounting (IAS – IFRS) for the country, under this role, Carol co-wrote the standards of accounting and financial information currently applicable in Colombia. Ms. Ortega has authorship on numerous accounting and business related academic publications worldwide. In the U.S., as the Director of Finance and Operations for Adelante Mujeres, Ms. Ortega leaded the research and implementation of the incubator, accelerator and micro-finance program, now the biggest one in the State of Oregon serving the Latino community. as the Deputy Executive Director for InStove, she established the organization strategy, resulting in the first place at the Portland Social Venture Society “Fast Pitch” competition among others, taking InStove from a start-up to a sophisticated, sustainable, growth-oriented, multinational organization.Ms. Ortega has provided business & financial consultancy services to legal cannabis start-ups in the U.S. since 2014, year when Recreational Cannabis was legalized in the State of Oregon and in Colombia since December 2015. Carol is the Founder & BOD Chair of the Colombian Cannabis Entrepreneurs Network (RECC), which foster and serves through its programs and services cannabis ventures in Colombia, founding entity of the first cannabis science event in the Americas called CannaCiencia, a state of the art event that promotes science, research, investment and good practices of the analytical laboratory of Medicinal Cannabis in the Americas. Carol earned a B.S. in Accounting & Finance a Master’s degree in Management Accounting, from Xavierian University in Bogota, and a Master’s in Business Administration from Canisius College. Buffalo, New York. About Muisca Capital Group Muisca Capital Group is the first Latin American investment management firm strategically targeting the emerging legal industry of medicinal cannabis. We establish investment and execution policies that allow us to generate an optimal allocation in diversified portfolios where profitability is maximized minimizing risk. Our due diligence process is traversal and covers the strategic, commercial, operational, financial, IT and corporate social responsibility aspects. Our team of financial consultants, risk managers and business developers combine decades of experience in the financial, pharmaceutical, governmental, academic and service industries in the Americas.

|

Dr. David Cunic, CEO, UCS Advisors

|

David M. Cunic is an entrepreneur who specializes in Investor Relations Advisory services. "Dr. David", as most people know him as, has raised capital, expanded several companies, and has employed over 300+ people. He has been in the medical field for 18+ years, has been a business owner for 19+ years, and has been in the cannabis industry for 10+ years. Some people have called him the "triple headed dragon" due to his diversity and experience. Over the past 16 years, Dr. David has started over 10+ companies, in both the public and private sector, and has successfully sold many of them. His efforts in business operations and human resources won him the prestigious Alfred Sloan Award for Workplace Programs and Flexibility. David has assisted many companies in securing millions of dollars for his clients ranging from the cannabis, hemp, energy, medical, water, and the beverage industry. He has served on numerous boards as an advisor and trusted source of information. Dr. David also performs presentations and speaks at conferences on a variety of topics in both the medical sector and cannabis industry.

|

Gary Krimershmoys, Investment Banker, Young America Capital

|

Gary Krimershmoys is a FINRA licensed Investment Banker in the cannabis industry that provide capital raising. mergers and cquisitions, restructurings, private placement and strategic advisory services.

Gary’s experience spans capital markets, founding and operating startups and dealing in art. Positions included Partner of an option market making firm at the American Stock Exchange NYC, Head of Structured Credit Derivative Sales at Tullett Prebon London, and capital raising and financial advisory in ESG investments. As a business operator, he founded an e-commerce company, owned an art gallery in NYC and an art advisory business with offices in London and NYC. Gary is a Director of Corporate Development at The Blinc Group, a designer and distributor of cannabis vaping hardware. At Young America Capital he is a Registered Representative with a FINRA Series 7 License Gary received a BS in Commerce and Engineering, double majoring in Marketing and Finance, cum laude, from Drexel University. About Young American Capital Young America Capital is a rapidly rising New York based FINRA/SEC licensed independent investment bank. We provide capital raising, M&A, and financial advisory services to meet the needs of middle market companies and family businesses. We also offer placement agent services to advance the institutional marketing efforts of alternative investment fund managers. The firm is comprised of a diverse group of senior investment banking professionals. Our experience across Telecommunications, Media, and Technology; Lifesciences & Healthcare; Consumer; Maritime & Infrastructure; Cleantech; Real Estate and Latin America provides us with deep industry knowledge and an exceptional network to orchestrate and structure the optimal transactions for our clients. Young America offers clients direct access to senior-level deal makers that have the expertise and freedom to impact the long term well being and vitality of your business. We pride ourselves on our high-level of integrity, service, flexibility, and know-how.

|

Jeffrey Glick, CFO, Start U Up

|

Jeff Glick has more than 30 years of financial, administrative, and logistics management experience. His specialty is to allow companies to be “bankable”; or the ability to tell “where they were, where they are and where they are going”.

Currently, Jeff serves as an out-sourced CFO for a variety of sophisticated startup and emerging companies. Such as: underwater renewable energy technology, an international waste water treatment developer, a private equity fund focused on the emerging cannabis industry, and others. Jeff founded START U UP in 2011. START U UP serves as the outsourced CFO to start up and emerging companies. Target clients include but not limited to private companies, family offices, hedge funds, private equity funds, and sovereign wealth advisors. Before founding START U UP, he served as the CFO for Sagard Capital. Sagard is a hybrid fund that invests across the hedge and private equity spectrum. Before Sagard he was the Chief Financial Officer of Almaz USA, Inc (16 years) — an international commodity trading and marketing firm. He joined Almaz as a startup, and helped it grow its revenues to in excess of $2 billion dollars annually. Jeff also applied his CPA skills as a Back Office Manager and Manager in the Mergers and Acquisition department of Phibro Energy, the oil trading and refining arm of Salomon Brothers. He also worked at Merrill Lynch as an internal auditor. Jeff holds a BS in accounting from The State University of New York at Binghamton, and has been a standing member of the American Institute of Certified Public Accountants Association and the New York State Society of CPA’s since 1985. He holds FINRA Series 65 and NFA Series 3 designations. Jeff and his family have been residents of Darien CT for 25 years. He has been active board member of Temple Shalom in Norwalk, CT and a travel team manager for almost 10 years at Darien Youth Hockey. He is a big fan of UCONN and University of Michigan athletics. About Start U Up Start U Up provides professional executive management services on an outsourced basis. Our expertise with chief financial officer responsibilities, human resources, and legal and compliance oversight help in the formation of new firms… … and with operations as businesses grow. But growing doesn’t mean having to spend a lot more on overhead. Start U Up functions as long-term trusted advisors, providing economical ongoing professional management for a fraction of the cost of full-time employees.

|

Scott Berman, Principal, The Panther Agency

|

Scott joined the Panther Opportunity Fund (“Panther”), a vintage 2017 cannabis focused venture capital fund with a complementary and diverse set of 14 portfolio companies, in 2017 as a Principal and member of the investment committee. Scott first entered the cannabis space in 2014 when he co-founded the Cannabis Rep Network (merged into Calyx Distribution) to provide sales & distribution for brands in California. Prior to Calyx, Scott co-founded a data-driven digital ad agency called Audience Partners in 2007, targeting addressable audiences for the political and healthcare industries. Scott has a degree from the University of Maryland and began his career in a family Jewelry manufacturing business based in Philadelphia. From 1988 to present, Scott has worked for the Philadelphia 76ers, as head statistician for all home games.

About The Panther Agency The Panther Agency (TPA) was created in 2020 to leverage our team’s ad-tech experience of 15+ years to help scale cannabis businesses. Operating at the intersection of cutting-edge ad-tech and the cannabis industry, TPA provides its clients with solutions to activate your customer data and target prospects across ALL media channels.

|

Terry Buffalo, CEO, American Cannabis Company

|

Terry Buffalo is a seasoned executive in the financial services that that transitioned into the cannabis sector. Mr. Buffalo serves as the Chief Executive Officer of American Cannabis Company, Inc. (ACC) based in Denver, Colorado. His ability to convey complex information in a concise and straightforward manner combined with his expertise in investment, regulatory compliance and audit responsibility has positioned Mr. Buffalo to be an effective member of the ACC team as the company continues to expand.

About American Cannabis Company ACC began in 2013 as a fully-fledge provider of end-to-end industry-specific consulting solutions for those looking to start or improve their operations. After having secured many license opportunities for clients both domestically as well as internationally, the ACC brand is pivoting to become a vertically integrated multi-state operators.

|

Tim Lozott, CEO, Green Life Capital

|

Tim Lozott, a US Marine veteran has expertise at the C-Suite, V-Suite and senior management level in the the real estate, hospitality, consumer packaged goods, digital media, and cannabis sectors. He most recently effected organizational turnaround and took an underperforming and undercapitalized cannabis company to a performing thriving company, the result was taking the company to a successful liquidity acquisition event of $70M, which was just under 9x the capital invested. He has expertise and over two decades of professional experience in finance and operations management within start-ups and global multi-billion-dollar organizations, including experience in capital raising, mergers & acquisitions, investment fund management and growth strategy development. Mr. Lozott’s experience from the REIT and REIT investment fund management industry includes leading large teams across multiple locations: raising over $1.5 Billion in asset backed securities; raising over $2 Billion in private-equity investments from institutional investors, and obtaining over $250 million in debt financing.

Green Life Capital “We make it easier for small private companies to raise capital by providing one-stop, full-spectrum capital solutions and strategic advisory services” Green Life Capital is an investor and a strategic partner…empowering private-equity, small-cap companies and providing one-stop, full capital stack investment and strategic advisory services. Last year our team deployed $120 million in commercial real estate loans and $43 million in working capital loans. This year we have $500 million in assets under management to deploy in debt financing, and we have an extended network with access to over $6 billion. Whether it is speed or price you are looking for, look no further than Green Life Capital. We are also raising capital for our private-equity funds, business development company fund and our venture capital funds. After much thought about what we can bring to emerging growth companies we landed on, Teamwork, Communication, Effecting Change, Agility, Innovation, Simplification, Efficiency, and Profitability. We're filling a huge void by 1) bringing professional institutional funding to small-cap emerging growth companies, 2) maintaining a niche focus on industries that we understand and where we have operational experience, and 3) providing strategic advisory services to the young companies competing in their space. We have a team of experts and have developed relationships that are centered around navigating the issues of emerging growth companies, mitigating risks, strategic growth and development. In addition to investing capital in selected Client Companies, we also makes sure each client has a clearly defined business and financial plan, and the ability to reach its financial goals and objectives. Because of our expertise to help companies obtain successful funding and execute business strategies post-funding our Client Companies have the ability to secure additional funding far more efficiently than otherwise possible. We pride ourselves in having a Disciplined Investment Philosophy developed over years of experience in capital markets. Our investment approach emphasizes value-add, capital preservation, minimization of downside risk, in addition to engaging in due diligence from the perspective of a long-term investor. Whether you're a company seeking to raise capital or an investor - consider joining us on our mission to be the pre-eminent source of expertise and capital and market support for emerging growth small-cap private companies.

|